Homeowners, File for your Homestead Exemption before the March 2 deadline! (Orange County, Florida)

SAVE ON PROPERTY TAXES WITH HOMESTEAD EXEMPTION

WHAT IS HOMESTEAD EXEMPTION?

Florida Law entitles everyone who has legal or equitable title to real estate and maintains it as his/her permanent residence to apply for a homestead property tax exemption.

AM I ELIGIBLE TO FILE?

You must meet the following requirements as of January 1:

• Legal or beneficial title to the property recorded in the Official Records of Orange County

• Reside on the property

• Be a permanent resident of the State of Florida

• Be a United States citizen or possess a Permanent Residence Card (green card)

HOW LONG DO EXEMPTIONS CONTINUE?

Your exemption will automatically renew each January as long as title does not change on the property and your residency status remains the same. Florida Law requires a new application when a title change occurs. You must inform the Orange Country Property Appraiser’s Office of any change in use of the property.

DOES MY EXEMPTION FOLLOW ME TO MY NEW HOME?

No, it does not. If you move after January 1, the exemption will continue for the remainder of the year on the property where the exemption was initially filed. You must file a new application when you move to a new residence.

THE DEADLINE TO FILE IS MARCH 1

HOW TO FILE

Online

Log onto the Orange Country Property Appraiser’s website at www.ocpafl.org, click on the ‘Online Filing’ link and use the user login and password provided by our customer service department.

Mail

Complete an application and return to:

Orange County Property Appraiser’s Office

200 S. Orange Ave., Suite 1700, Orlando, FL 32801

Office

Visit our office in the SunTrust Towers at 200 S. Orange Ave, 17th floor, Orlando, FL.

Monday to Friday, 8:00 a.m. to 5:00 p.m.

You can also file during the 2020 Property Tax Savings EXPO on Sat, February 15, 2020, 10:30 AM to 2:30 PM at Orlando Public Library (Albertson Room – 3rd Floor) CLICK HERE TO REGISTER

ADDITIONAL HOMESTEAD EXEMPTION

Amendment 1 provides an Additional Homestead Exemption, of up to $25,000, which is applied to Assessed Value above $50,000.

This table shows the Homestead Exemptions that apply based upon the assessed value of your property.

| IF YOUR ASSESSED VALUE IS… | YOUR EXEMPTION WILL BE… |

| $75,000 and up | Original $25,000 Homestead Exemption plus Full $25,000 Additional Homestead Exemption |

| $50,000 to $75,000 | Original $25,000 Homestead Exemption plus Additional Ammendment 1 Homestead Exemption up to $25,000 |

| $1 to $50,000 | Original $25,000 Homestead Exemption & NO Additional Ammendment 1 Homestead Exemption |

The Additional Homestead Exemption does not apply to school millages.

OTHER AVAILABLE EXEMPTIONS

Our office offers several different exemptions. You must meet the exemption requirements as of January 1 to be eligible:

WIDOW / WIDOWER ($500)

May not be divorced or remarried

DISABILITY ($500)

Totally and permanently disabled or legally blind

DISABILITY (TOTAL EXEMPTION)

• Quadriplegic, hemiplegic, paraplegic, legally blind, or total and permanent disability that requires the use of a wheelchair for mobility

• Have a total gross household income under the annual limit

VETERAN SERVICE CONNECTED DISABILITY ($5,000)

A service-connected disability rating of 10% or more

VETERAN SERVICE CONNECTED SPOUSE DISABILITY ($5,000)

Spouse of a deceased service-connected disabled veteran with rating of 10% or more

VETERAN SERVICE CONNECTED DISABILITY (TOTAL EXEMPTION)

A total and a permanent service-connected disability

VETERAN SERVICE CONNECTED SPOUSE DISABILITY (TOTAL EXEMPTION)

Spouse of deceased total and permanent service-connected disabled vet

COMBAT RELATED DISABILITY DISCOUNT

• Must have a combat-related disability from the Veteran’s Administration and be 65 years of age

• Must be a Florida resident when enlisted

DEPLOYED MILITARY EXEMPTION

• Must be deployed on active duty in support of Noble Eagle (began 09/15/01), Enduring Freedom (began 10/07/01), Iraqi Freedom (3/19/03 thru 8/31/10), New Dawn (9/01/10 thru 12/15/11) or Odyssey Dawn (3/19/11 thru 10/31/11)

For more information on how to file for these additional exemptions, visit the Orange County Property Appraiser’s website www.ocpafl.org or call our office at (407) 836-5044.

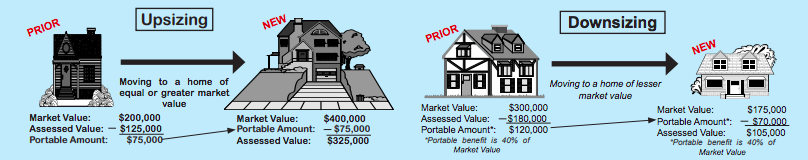

PORTABILITY

Portability is the ability to transfer up to $500,000 of accumulated Save Our Homes “Savings” from an existing or prior homestead property to a new property established as your homestead within two years of selling or abandoning your existing or prior homestead.

Below are examples of how Portability is applied when upsizing or downsizing your property.

To apply, you must complete a DR501T, ‘Transfer of Homestead Assessment Difference’, when you file an application for your new homestead exemption. You may also download this form from the Orange County Property Appraiser’s website at www.ocpafl.org.

LIMITED INCOME SENIOR

WHAT IS THIS EXEMPTION?

Florida Law allows for counties and municipalities to grant an additional Limited Income Senior homestead exemption of up to $50,000. The law also requires an annual application, unlike original homestead exemption which is renewed automatically. This is because Limited Income Senior exemption is based upon age and income. This exemption does not reduce your assessed value until after regular homestead

exemption is applied and only reduces taxes within the jurisdiction which approved the exemption. Orange County as well as the cities of Apopka, Belle Isle, Edgewood, Orlando, Winter Garden and Winter Park and Towns of Windermere and Oakland have authorized up to $50,000 additional exemption to date. The City of Ocoee and Town of Eatonville has only authorized up to $25,000 Limited Income Senior exemption.

WHO IS ELIGIBLE TO RECEIVE THIS EXEMPTION?

To be eligible for the additional Limited Income Senior exemption, a homeowner must have or qualify for regular homestead, own and reside on the property as your permanent residence and be 65 years of age or older on January 1st. Your adjusted gross income must not exceed the annual limit. The 2013 limit is $27,590, adjusted annually. Please check our website for more details.

HOW CAN I APPLY?

Contact our office at (407)836-5044 and we will mail you an application, or download an exemption application from the Orange County Property Appraiser’s website at www.ocpafl.org from January 2 – March 1. Remember, the application must be submitted to the Property Appraiser’s Office no later than March 1 of each year. When applying for the first time, you must submit all income documentation by June 1 in the year you applied for the exemption.

EXEMPTION ABUSE HOTLINE

Report Abuse and Remain Anonymous

407-836-5046

When a property owner receives, but is no longer entitled to a homestead or agricultural exemption, it is deemed to be non-compliant and abuse of the law.

If you know of a property in Orange County currently receiving a tax reduction from a homestead or agricultural exemption, which you believe should not be receiving such reduction due to an abuse of the law, we urge you to report the property by calling our Exemption Abuse Hotline.

VISIT THE ORANGE PROPERTY APPRAISER’S WEBSITE AT WWW.OCPAFL.ORG FOR MORE INFORMATION.

ORANGE COUNTY PROPERTY APPRAISER’S ADDRESS: 200 S. ORANGE AVE, SUITE 1700, ORLANDO, FL

ORANGE COUNTY PROPERTY APPRAISER’S CONTACT NO.: (407) 836-5044